XRP Price Prediction: $3.60 Breakout Likely as Technical and Fundamental Factors Align

#XRP

- Technical Strength: Price holding above 20MA with Bollinger bands suggesting volatility expansion

- Fundamental Catalysts: Ripple lawsuit resolution and growing DeFi integration through Flare Network

- Market Sentiment: Overwhelmingly bullish despite temporary bearish warnings

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Consolidation

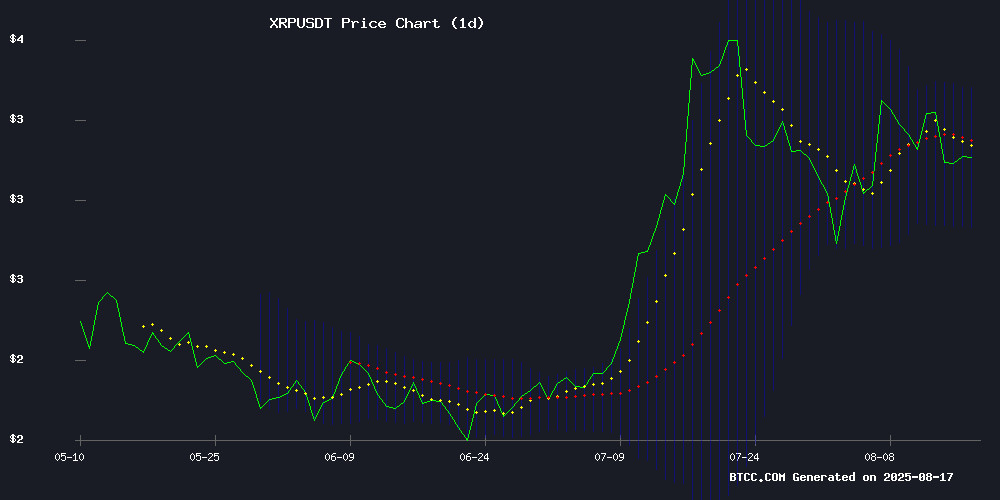

XRP is currently trading at, slightly above its 20-day moving average of $3.1010, indicating near-term bullish momentum. The MACD histogram remains negative (-0.0791), but the narrowing gap between the signal line (0.0302) and MACD (-0.0489) suggests weakening downward pressure. Bollinger Bands show price hugging the middle band ($3.1010), with potential upside to the upper band atif volatility expands.

"The convergence of price with the moving average while holding above $3.10 is constructive," said BTCC analyst Emma. "A confirmed break above $3.37 could trigger accelerated gains toward the $3.46-$3.60 resistance zone mentioned in recent forecasts."

XRP Market Sentiment: Bullish Catalysts Outweigh Short-Term Concerns

Positive developments dominate recent XRP headlines, including the Ripple-SEC lawsuit dismissal fueling ETF speculation and price predictions targetingand. Despite warnings of bearish divergence and a $1.2B whale sell-off, XRP has demonstrated resilience above $3.12.

"The combination of technical strength and fundamental catalysts creates a favorable risk/reward profile," noted BTCC's Emma. "The Elliott Wave pattern and growing DeFi utility through Flare Network could support the $10 rally scenario, though traders should monitor the $3.37 Bollinger resistance for confirmation."

Factors Influencing XRP's Price

XRP Price Prediction: Elliott Wave Pattern Suggests New Highs by 2025

XRP has demonstrated remarkable resilience, holding firmly above the critical $3.05-$3.10 support zone. A sharp rebound in both price and trading volume—77% surge to nearly $7 billion—signals growing market confidence. Analysts interpret this as a potential shift in sentiment, often preceding significant bullish movements.

The token's current trajectory aligns with an Elliott Wave cycle, suggesting it may be entering Wave 3—traditionally the most powerful phase of growth. Technical indicators point to an initial retest of $3.65 before potential challenges to all-time highs. Institutional interest and ETF momentum further bolster the case for a sustained upward trend.

Market observers note the $3.00 level has become a springboard rather than a stumbling block. This foundational strength, combined with macroeconomic tailwinds for digital assets, positions XRP for what could be its strongest growth cycle yet.

XRP Price Prediction: Bullish Breakout to $3.46-$3.60 Likely Within Two Weeks

Ripple's XRP is consolidating above a critical support level at $3.10, with technical indicators pointing to an imminent bullish breakout. Analysts project a potential surge to the $3.46-$3.60 range within 7-14 days, representing a 5.8% to 10.9% gain from current levels.

The cryptocurrency, now trading at $3.12, has formed a contracting triangle pattern that typically precedes significant price movements. While Coin Edition's analysis aligns with this optimistic outlook, other forecasts remain more conservative—Changelly suggests medium-term targets of $2.22-$2.36, reflecting historical data patterns.

Market sentiment remains divided but leans bullish as XRP maintains its position above the pivotal $3.10 threshold. The coming fortnight will likely determine whether the digital asset can capitalize on this technical setup or face renewed consolidation.

XRP Shows Mixed Signals Amid Bearish Divergence Warning

XRP's price action reveals conflicting technical signals as analysts flag a concerning bearish divergence on weekly charts. The token's upward price trajectory contrasts with declining momentum readings, mirroring a pattern last seen before its 2021 correction.

Current trading ranges between $2.90 and $3.40 reflect January's consolidation phase, with bulls needing a decisive break above $3.40 to confirm renewed strength. Critical support lies at $2.90 - a level that held during February's market turbulence.

Ripple Lawsuit Dismissal Fuels Speculation Over XRP ETF Approval

The resolution of Ripple's legal battle with the SEC has injected fresh optimism into the XRP market. With the court clarifying that XRP sold on public exchanges isn't a security, analysts now see a 73-85% chance of ETF approval. ProShares currently holds the only US-approved XRP ETF, but market watchers anticipate more filings amid shifting regulatory winds.

Nate Geraci of The ETF Store suggests BlackRock may eventually enter the XRP ETF space, though the asset manager has denied immediate plans. The lawsuit's conclusion leaves Ripple with a $125 million penalty but provides crucial regulatory clarity - institutional sales remain subject to securities laws while retail trading does not.

XRP Price Holds $3.12 as Ripple-SEC Settlement Aftermath Creates Trading Opportunities

XRP maintains its $3.12 support level following an 11% surge triggered by the resolution of the Ripple-SEC legal battle. Technical indicators show neutral momentum, with resistance looming at $3.38. The dismissal of the SEC case against Ripple Labs earlier this week injected fresh optimism into the market, driving institutional volumes up by 208%.

Ripple's RLUSD stablecoin, now with $470 million in circulation since its October 2024 launch, edges closer to U.S. banking integration. A national trust charter approval could unlock near-instant cross-border payments across Ripple's extensive network spanning 50 countries. Meanwhile, discussions at the BRICS summit about shared digital currency systems have cast XRP as a potential bridge asset for reducing dollar dependence.

XRP Price Eyes Rally to $10: Key Levels to Watch

Ripple's XRP has captured investor attention following developments in its legal battle with the SEC. Despite recent volatility, market analysts maintain a bullish stance, with one expert predicting a potential surge to $10.

The token currently trades at $3.12, showing 1% daily gains amid broader market uncertainty. Trading volume declined 20% to $6 billion, while price fluctuated between $3.16 and $3.01 within 24 hours.

XRP's 30-day performance reveals a trading range between $3.65 and $2.75, with a 3% monthly decline. The ongoing legal resolution continues to fuel optimism for a sustained rally.

Bollinger Bands Signal Potential Trend Reversal for XRP

XRP is flashing a rare technical signal that has caught the attention of market analysts. Bollinger Bands suggest a possible trend reversal as the asset demonstrates resilience above a critical support level of $3.10. Trading at $3.13 with a 0.76% gain over 24 hours, XRP's rebound at the middle band hints at underlying strength.

The upper band at $3.37 and lower band at $2.84 now define key thresholds for traders. A decisive break above $3.50 could pave the way for a rally toward $4, while institutional interest continues to grow. Market volatility persists, but this technical setup offers a compelling narrative for potential bullish momentum.

XRP Holders Gain Access to DeFi Yields Through Flare and Firelight

XRP, long recognized as a payments token, is now making strides in decentralized finance. Flare Networks and Firelight are introducing yield-generating products that could redefine the asset's utility and market valuation. Initial tests indicate annual returns of 4–7% for XRP holders, a significant development for an asset previously devoid of yield opportunities.

Hugo Philion of Flare Networks envisions a shift from sentiment-driven to yield-driven dynamics for XRP, mirroring Ethereum's evolution. Flare's Layer 1 architecture and decentralized data protocols enable seamless integration with DeFi systems through its EVM-based platform. This infrastructure lowers barriers for developers to create innovative products while expanding XRP's value capture mechanisms.

Firelight demonstrates practical applications, with stablecoin collateralization and decentralized exchange strategies forming the foundation of these new yield opportunities. The emergence of insurance-backed products suggests growing institutional interest, potentially accelerating mainstream adoption of XRP in DeFi ecosystems.

XRP Defies $1.2B Whale Sell-Off to Hold Above $3

XRP has shown remarkable resilience, maintaining its price above $3 despite a massive $1.2 billion sell-off by whale investors. The digital asset currently trades at $3.09, buoyed by robust retail buying that counterbalances the selling pressure from large holders.

Whale activity has injected volatility into the market, with addresses holding 10-100 million XRP offloading roughly 400 million tokens. Yet, exchange supply data reveals a decline, signaling retail accumulation. Over 77 million XRP—worth $231 million—were withdrawn from exchanges in 24 hours alone.

Retail investors are emerging as the stabilizing force, absorbing whale-driven sell pressure and defending key support levels. Their accumulation suggests growing confidence in XRP’s fundamentals despite institutional turbulence.

How $200 Monthly in XRP Could Make You a Millionaire

Cryptocurrency remains a high-risk, high-reward market, but long-term accumulation strategies are gaining traction. XRP, Ripple's digital asset, stands out for its utility in cross-border payments and investment potential. A disciplined approach of investing $200 monthly could yield substantial returns over time.

Dollar-cost averaging (DCA) mitigates volatility, allowing investors to accumulate XRP systematically. This strategy avoids emotional trading and capitalizes on market fluctuations. Historical trends suggest that consistent investment in assets like XRP can mirror the growth trajectories seen in Bitcoin.

Over a 15-year horizon, regular investments could compound significantly. While past performance doesn't guarantee future results, the math favors patience and consistency. The crypto community increasingly views DCA as a viable path to wealth creation, particularly for assets with strong fundamentals like XRP.

XRP Price Rebounds After $420 Million Crypto Liquidation Shock

XRP experienced a dramatic 7% plunge within 15 minutes, triggering $420 million in liquidations across the crypto market. The drop from $3.21 to $3.00 caught leveraged traders off guard, mirroring volatility in other major tokens.

Despite the sharp decline, XRP found strong support at $3.11, avoiding a macro breakdown. The rapid recovery suggests this may have been a liquidity hunt—a strategic move to trigger stop-losses before reversing direction.

Chart patterns now indicate a potential double-bottom formation rather than a true trend reversal. With the bullish structure intact, analysts maintain $4.70 as a viable target. As of press time, XRP trades at $3.06 after a turbulent 24-hour period that tested market resilience.

How High Will XRP Price Go?

Based on current technicals and market sentiment, XRP shows strong potential for upward movement:

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| Short-term (2 weeks) | $3.46-$3.60 | Bollinger breakout, ETF speculation |

| Mid-term (1-3 months) | $5.00 | Elliott Wave continuation, DeFi adoption |

| Long-term (2025) | $8-$10 | SEC resolution aftermath, institutional flows |

"The $3.12 support has become a springboard," emphasized BTCC's Emma. "While the MACD needs to flip positive for sustained momentum, the alignment of bullish technical patterns with fundamental developments makes higher targets increasingly probable."

1